- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

The Pros and Cons of Biting Into This Struggling Restaurant Stock

It’s Wednesday. That means I’m talking about stocks hitting 52-week highs and lows. Yesterday, 77 Nasdaq stocks hit 52-week highs while 75 hit 52-week lows. On New York, 57 hit 52-week highs and 2o hit 52-week lows.

One of the names on the Nasdaq hitting a new 52-week low that caught my eye is Portillo’s (PTLO), the Chicago-based fast-casual restaurant serving local food favorites such as Chicago-style hot dogs and other tasty treats.

The restaurant chain went public in October 2021 at $20 a share, peaking a month later at $57.72. Its shares have lost 88% of their value in the four years since. Despite the apparent shareholder value destruction, there’s an argument to be made that the shares, while perhaps not worth $20 at this point, aren’t a single-digit stock either.

The truth is somewhere in the middle. Here are my pros and cons about investing in Portillo’s at this point in its history as a public company. At the end, I’ll give you a yay or nay on buying PTLO stock.

What Happened to All Portillo’s Potential?

The one thing I pride myself on is accountability. When I make a poor call, I have no problem admitting as much. In April 2024, for another publication, I selected Portillo’s along with two other restaurant stocks that analysts favored. I reckoned that at $13 and expanding outside its Chicagoland base, it was a good value play.

In hindsight, we know I was spectacularly wrong. Instead, PTLO shares have lost nearly 50% of their value over the past 17 months.

What went wrong? If I had a concrete answer for you, I’d be a wealthy man. Alas, that’s not the case.

The weird thing is, analysts still appear to like it. Of the 12 covering its stock, seven rate it a Buy (4.17 out of 5), with a mean target price of $11.90, considerably higher than yesterday’s $6.90 closing price.

Interestingly, over the past 17 months, the pure-play AdvisorShares Restaurant ETF (EATZ) -- which invests in 22 restaurant and foodservice stocks -- is up nearly 21% over this period, considerably better than Portillo’s stock, but 400 basis points less than the S&P 500. The actively-managed ETF has delivered a good, if not great, performance for its shareholders. But I digress.

Therefore, there have to be company-specific issues that have crushed its share price.

Cutting to the chase, issues affecting its share price in recent months include operational problems in Texas, poor same-store sales, and weak guidance.

Portillo’s reported Q2 2025 results on Aug. 5 before the markets opened. PTLO stock lost 23% that day.

On the top line, its revenues were $188.5 million, 3.6% higher than a year ago, but $8.0 million shy of the Wall Street consensus. Further, its same-store sales grew just 0.7%. If not for the nine locations it opened between Q2 2024 and Q4 2024, revenues would have decreased year-over-year. In the first six months of 2025, it hasn’t opened any new locations.

On the bottom line, it earned $0.12 a share, two cents higher than Q2 2024, and equal to the consensus estimate. All the profitability metrics were flat, slightly up, or slightly down relative to a year ago. Neither good nor bad on the earnings front.

Texas is mentioned 31 times in the company’s Q2 2025 conference call transcript. For example, its Texas restaurants open for less than 24 consecutive months (the criteria for inclusion in same-store sales comparisons) got off to a slow start in 2025. Adding to this are significant delays in opening its location in Stafford, Texas, which points to operational breakdowns eroding investor confidence.

Lastly, its revenue guidance for 2025 was revised downward, from 11% growth previously at the midpoint, to 6%, nearly a 50% cut. Otherwise, its guidance hasn’t changed all that much.

I was expecting much worse.

The Value Proposition

As I said in the introduction, Portillo's stock once traded near $60. Buy in at today's prices and you’ve got the potential for a 10-bagger. I’m saying this with my tongue firmly planted in my cheek.

However, as I finished the last section, I was expecting much worse from its financials, given the 42% decline in its share price over the past 12 months.

From the balance sheet, we can see that Portillo’s had $630.2 million in total debt as of June 29, 121% of its market cap. While that’s high, over half the total debt is for its leases on its locations.

The more important number is its interest expense. Over the last 12 months, through the end of June, it was $24.0 million, according to S&P Global Market Intelligence. That’s about 28% of its operating cash flow, which is manageable. Still, its Altman Z-Score -- the Altman Z-Score indicates the likelihood of a business entering bankruptcy proceedings over the next 24 months -- is 0.96, suggesting it remains distressed.

PTLO is not a stock for your kid’s education fund.

That said, Portillo’s enterprise value in Q4 2021 was approximately $2.37 billion -- when its share price was in the $50s -- 16.51 times its trailing 12-month EBITDA (earnings before interest, taxes, depreciation and amortization). Today it’s $1.14 billion, or 9.1 times EBITDA.

An argument is made that its market cap should be at least several hundred million dollars higher. In Q4 2021, its EBITDA margin was 9.9%. Today, it’s over 13%. Furthermore, its EBITDA today is 5.2 times its interest expense compared to 1.8 times in Q4 2021. Meanwhile, its total debt today is 5.1 times EBITDA, only marginally lower than 5.8 times in Q4 2021.

The Bottom Line

Is this the best stock you could own? Of course not.

What I’m suggesting is that while Portillo’s was never a $60 stock, it’s also fair to say it isn’t a $6 stock either. The question is: what is the actual intrinsic value of PTLO? My guess is it’s closer to the teens than the $40s.

Is there much downside here?

Well, admittedly, I was wrong about Portillo’s when it was trading around $13 in April 2021, so I’m not the best judge of value in this instance. However, if you’re an aggressive investor, PTLO isn’t the worst bet you can make among yesterday’s stocks hitting new 52-week lows.

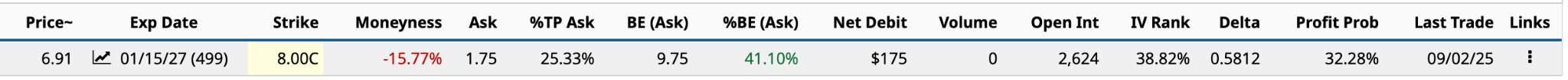

I like this call option expiring in January 2027 as a cheap way to take a flyer. The $175 premium has a breakeven of $9.75, or 41% higher than where it currently trades. The last time it traded around $9.75 was in early August. With 499 days to expiration, it has plenty of time to get back there.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.